Fewer than half of U.S. households have traditional cable television subscriptions, according to research done by PricewaterhouseCoopers (PWC). With the end of network neutrality rules, cable companies, AT&T and, to a lesser extent, other telcos will be able to fight this trend more aggressively. Even if they can’t stop or even slow it, they can use their monopoly broadband gatekeeper power to rake in a greater share of subscriber revenue.

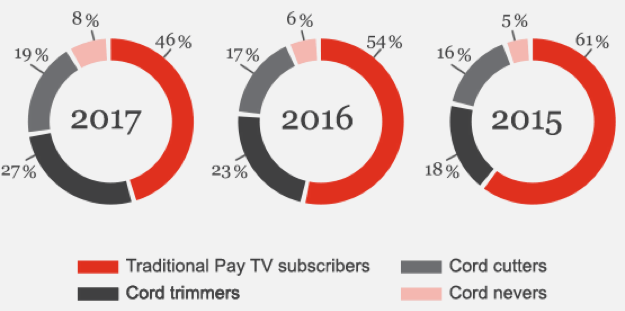

Cable TV subscriptions have been trending downward over the five years that PWC has been running this survey. A total of 73% of homes have cable (or satellite) TV service, but that breaks down to 46% traditional, big line up subscriptions and 27% “cord trimmers”, who are people who have skinnier packages that they supplement with online – over the top (OTT) – services.

Even so, the cost of watching video keeps going up…

The number of traditional Pay TV subscribers continues to drop as more people are trimming or cutting the cord completely.

73% of our respondents subscribe to Pay TV, which is down from 76% last year and 79% the year before.

At the same time, people report they’re paying more for video today than they were last year.

53% of cord trimmers report paying more for their services in 2017 than they did in 2016; however, trimmers are still paying less than traditional subscribers overall.

Sports is the number one reason people keep paying cable TV companies. If there was another way to see live sports, 82% of sports fan would either trim back their cable subscriptions or chop them completely, according to PWC’s research.

Another interesting finding: 73% of households have Netflix, putting it dead even with cable and satellite providers on an overall basis, and way ahead of the old school, old business model subscriptions.

This accelerating shift away from linear television viewing – and subscriptions – has changed the game for broadband providers. Three years ago, when 61% of U.S. homes had traditional cable subscriptions, Google considered video to be an essential service offering on their fiber-to-the-home systems. But not any more.

As traditional video subscribers flee, cable companies and AT&T, which owns DirecTv, will be looking for ways to either bring them back, or charge more for other services. Like un-throttled, un-blocked and un-prioritised broadband service. If they continue to offer it at all.