Event horizon.

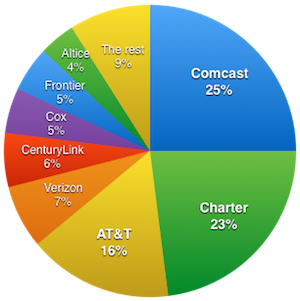

Comcast and Charter Communications own nearly half of the U.S. broadband market. That’s the result I get from crunching the second quarter 2016 high speed subscriber counts compiled by Leichtman Research Group. Comcast has a quarter of the market – 25% – and Charter has almost as much – 23%. After accounting for rounding, the combination of the two totals out at 47% of U.S. Internet service subscriptions.

AT&T is the only other Internet service provider with double digit market share, but still lags far behind at 16%. Verizon, CenturyLink and Frontier get 7%, 6% and 5% respectively. Cox at 5% and Altice with 4% are only other two in the same, small ballpark. The rest – Mediacom, Windstream, WOW, Cable One, FairPoint and Cincinnati Bell – are at 1% or less.

But that only tells half the story of cable’s market dominance. Charter, Comcast and other major cable companies do not compete against each other: they deliberately avoid going head to head in any given market. So when you compare the shares of the seven biggest cable companies with the seven biggest telephone companies – which is the only significant battle line of competition in the U.S – cable overwhelms telcos by a 59% to 36% margin, with the remaining 5% falling into the “other” bucket.

That gap is getting wider. Leichtman’s figures from last quarter show big cable getting bigger by half a million subs, mostly at the expense of telephone companies, which lost about 300,000. It’s bad enough that the U.S. broadband market is in the grip of a duopoly. The prospect of it being choked down into an effective monopoly looks increasingly inevitable.