Not much incentive to spend on copper.

Verizon’s wireline future is fiber, not copper. That’s the takeaway from yesterday’s quarterly earnings call, where Fran Shammo, Verizon’s chief financial officer, talked up the company’s wireless plans, and said that selling its mostly copper systems in California (and Florida and Texas) was a good move strategically, because the company’s wireline investments are focused on fiber…

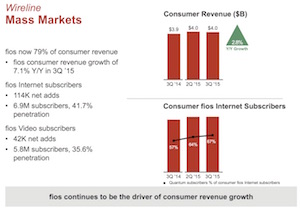

Most of that property was copper, not fiber. So when we look at the East Coast, it’s a much different footprint. We will have covered over 70% of the footprint with our [FiOS fiber to the home] product. This is a — we are very committed to it. We are investing over $4 billion into the Wireline company a year, so that shows our commitment from a capital investment perspective. We have already passed 20 million homes when we committed to originally 18 million, so we are very committed to the [FiOS] product.

Frontier Communications intends to buy Verizon’s Californian systems, but that seems to be taking a little longer than expected. Shammo said

he expects “to close the deal at the end of the first quarter of 2016”. Both companies have been pushing the California Public Utilities Commission to approve the transaction by December.

Verizon’s acceptance of $192 million in federal broadband subsidies on Frontier’s behalf was conditioned on getting the CPUC’s okay before the end of 2015. There’s more to closing the sale than regulatory approvals – transferring wireline operations and customer accounts from one company to another is complicated – so there’s no particular reason to worry at this point.

The real worry is what happens if the deal doesn’t go through. Most of the federal subsidies are earmarked for Verizon’s copper systems in rural areas of California, and if it keeps them it won’t take the money.

Or, as Shammo made clear, invest any of its own.