A national project to build fiber-to-the-premise infrastructure and offer it to any Internet service provider on a wholesale basis began in New Zealand in 2011, with an initial goal of reaching 75% of Kiwi homes and businesses. According to a study done by International Data Corporation, a research firm, and sponsored by Spark, the biggest NZ reseller of FTTP service, the build out has reached about 65% of NZ premises, and the goal is now to reach 87% by 2022.

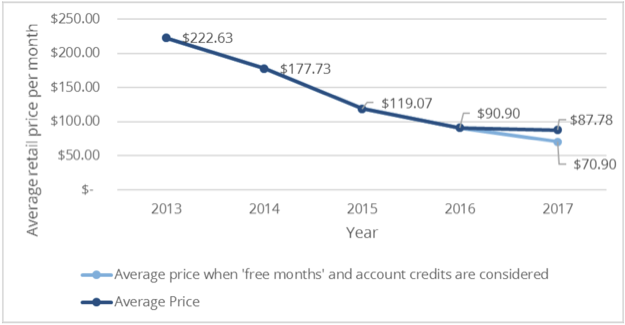

A total of 92 resellers are using the wholesale network to offer retail service. The resulting competition resulted in a drastic drop in retail prices, according to the report…

New Zealand telecommunication’s structural separation and national broadband plan have created new constructs and market dynamics. The [Ultra Fast Broadband] initiative has commoditised fibre in New Zealand. Consumer fibre plan prices have plummeted from averaging over NZ$200 per month in 2013 to around NZ$85 per month as at February 2018.

In U.S. dollars, that’s a drop from $144 (or more) per month in 2013 to $61 per month now.

The report questions whether the current level of competition can be sustained. But it also shows that there’s a big gap between the a long tail of small competitors and the handful of market leaders who, presumably, have staying power. Five companies own 91% of subscribers, and all have complementary businesses that share much of the operating costs, including marketing and subscriber management. One is Spark, which is the legacy telephone company in New Zealand, two are mobile carriers – Vodafone and 2degrees – and two are energy companies.

Even if there’s a huge cull amongst the remaining 86 providers, the level of competition will remain high. Five companies competing to offer gigabit class Internet service for $60 or so a month is a robust market, far more competitive than the monopoly/duopoly conditions in nearly all of the U.S..