Banks should be in the business of increasing Internet access and use in their communities, according to the Dallas branch of the federal reserve bank. Its white paper, Closing the Digital Divide, is a broadband primer for local bankers and those who would like to work with them. It details how broadband development initiatives can help banks meet obligations for local investment imposed by the federal Community Reinvestment Act.

The white paper makes three useful points. First, any effort to increase broadband use has to start with infrastructure…

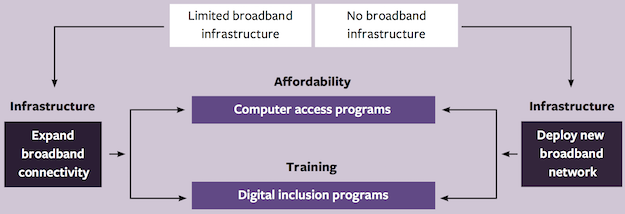

In communities with limited broadband infrastructure or no broadband infrastructure, investment in computer access or skills training will not be effective until investment in broadband infrastructure is developed. This is because owning a computer and knowing how to use it effectively are not relevant unless there is a sufficient connection to the internet.

Second, people need incentives to start using broadband in their daily lives, and online banking, particularly for those who have little or no access to financial services now, can be a powerful draw. Giving people computers and having them sit through a class on how to find a website are of little use without an underlying reason to do so.

Finally, the study correctly calls out middle mile infrastructure as a critical piece of the puzzle, and a worthy target for bank-grade loans or other investment. It’s the critical first step in any local broadband infrastructure development effort. Without it, investments in last mile access projects will never reach their potential, if they even survive at all.

The white paper’s major failing is that it gives banks an easy out. Despite the priority it puts on infrastructure investment, it also includes extensive boilerplate language about vague digital outreach programs that banks can slather onto the regulatory compliance reports they’re required to file, instead of getting involved in meaningful projects. Nevertheless, if there’s interest in broadband infrastructure investments, the federal reserve bank’s study is a good starting point.

Closing the Digital Divide: A Framework for Meeting CRA Obligations