Click for the full presentation.

The consumer electronics technology market is congealing into two products: smart phones and televisions. And even the television segment is showing weakness. That’s what the raw numbers say, although there’s more to it.

The first caveat is that sales figures are measured in U.S. dollars, and the dollar is getting stronger relative to currencies in key consumer electronics markets, particularly China. So products made and sold in China for yuan will be undervalued on a year over year basis if reckoned in U.S. dollars. So in absolute terms, the market isn’t as soft as it might first appear.

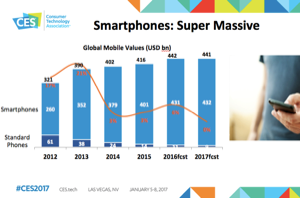

But comparing product category to product category is fair game. On that basis, smart phones are the only major segment that’s still showing growth on both a dollar and unit sales basis.

Steve_Koenig, the senior director for market research at the Consumer Technology Associations, which produces CES, [gave his annual analysis of the market yesterday](), focusing, as he does, on the Magnificent Seven – the top seven consumer electronics technology segments.

That is a sufficient number of segments to find the beginning of the long tail. Smart watches displaced dumb mobile phones for seventh place, with a forward looking sales estimate of $12 billion in 2017. Cameras are increasingly absorbed into smart phones. Desktop computers, laptops and tablets are slipping in both unit and dollar sales terms. All three categories are down individually and show an aggregate decline from 515 million units in 2014 to 380 million units projected for 2017.

That leaves smart phones and televisions. Smart phone unit volumes are up and expected to near 1.5 billion units sold in 2017, although the dollar value is expected to only nudge up slightly.

But TVs are softening, with 2016 and 2017 projections nearly the same and down significantly from their peak in 2014. A big part of the reason is that people are watching video on a variety of devices. In the U.S., barely half – 51% – of video viewing was on a traditional TV in 2016, according to CTA’s research, down from 62% in 2016. Smartphone and tablet viewing is up. Computer viewing is flat, although there’s a distinct shift from desktops to laptops. Smart phones are making the big dent in TVs share of eyeballs though, accounting for 21% of U.S. video viewing in 2016, versus 16% in 2012.

Big screen you can hang on your wall. Small screen you can put in your pocket. Everything else is apps and content.