Comcast and Charter own half of U.S. residential broadband subscribers, and their share of the market – if you want to call it that – is growing. That’s one of the conclusions gleaned from a tabulation of year-end 2017 financial reports by Leichtman Research Group. As with a similar count by FierceTelecom, the numbers show telcos continue to bleed subscribers profusely, while cable – and the overall broadband universe – keep on growing.

Leichtman’s report was published before Wow cable released its final 2017 financial results, so I added those into the totals. Over the course of 2017, the top cable companies added 2.7 million broadband subscribers, while the top telcos lost 626,000 subs. Big cable’s share of the, um, market was up a point to 61%, while the largest telcos lost a point, dropping to 34%.

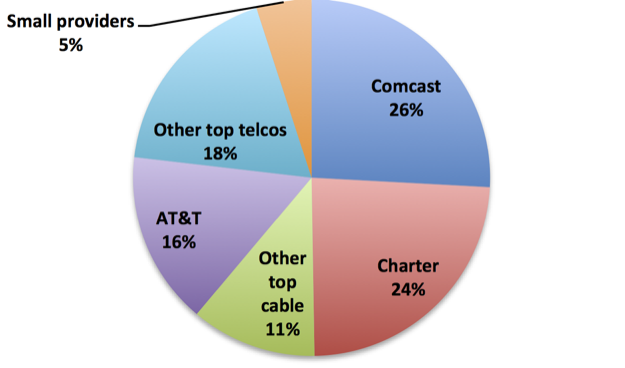

Overall, the race for broadband customers is down to a two and a half horses. Comcast has 26% and Charter is behind by a nose at 24%. Their combined 50% share (after rounding) is up from 48% at the end of 2016.

AT&T was the only other broadband provider to hit double digits, with 16% of U.S. broadband households. It was also the only big telco to show growth in broadband customers – fiber-to-the-home gains offset DSL loses, producing a net increase of 114,000 subs. Cincinnati Bell, a much smaller fry, was also in the black, adding 5,500 subs. All the other big telcos – Verizon, Frontier, Windstream and FairPoint – ended 2017 with fewer broadband customers than they started it with.

The top providers – seven cable companies and seven telcos – account for 95% of U.S. broadband households, according to Leichtman. Since it’s a choice between one cable and one telephone company, at most, for any given home, it’s technically a duopoly. But one with a junior partner who is on the ropes. Factor in cable’s overwhelming superiority in the 25 Mbps down/3 Mbps up and better category – the minimum federal standard for modern broadband service – and it looks more and more like a one player game.

If it prices like a monopoly, slams and crams like a monopoly and shows a monopoly’s lack of respect to its customers, then it’s a monopoly.