Cable companies own the residential wireline broadband market and are increasing their lead over telephone companies, at least where the major players are involved. An analysis piece by Sean Buckley in FierceTelecom breaks out the subscriber numbers for the 15 biggest Internet service providers in the U.S., ranked by total subscriber count as of 30 June 2017. It shows big cable with a 64% to 36% market share advantage and positive net subscriber growth, while big telco is stuck in reverse.

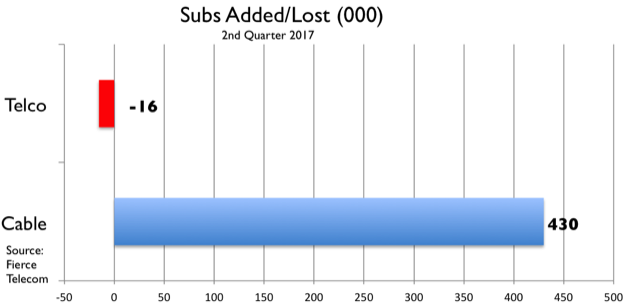

In the second quarter, the seven largest cable ISPs netted 430,000 new subscribers, while the eight biggest telcos lost 16,000 subs. The reason, according to Buckley, is consumers dumping outdated DSL-based service…

The effect of cable’s DOCSIS 3.1 drive was clearly felt by traditional telcos, which lost 233,260 more wireline broadband users, a slight improvement compared to the 360,783 this group lost during the same period in 2016. A big piece of this for large telcos such as AT&T and Verizon was the decline of DSL subscribers. AT&T and Verizon lost 104,000 and 72,000 legacy DSL subscribers during the quarter. But the biggest loser was Frontier Communications, which bled an additional 101,000 wireline broadband users. CenturyLink followed closely behind, losing 77,000 in the second quarter.

Comcast and Charter alone account for more than half of the market, with 27% and 24% shares respectively. Together, the two biggest telco ISPs – AT&T and Verizon – can’t even match Charter’s market share, let alone Comcast’s. AT&T has 16% of the total and Verizon has 8%, when added together and rounded, their total is 23%.

These latest numbers are good and bad news for big cable companies. Good, because sub count is the name of the game, and they’re winning hands down. Bad, because it’s one more data point that highlights a continually growing concentration of market power into a very few hands. When you take into account the fact that cable companies deliberately don’t compete with each other, on a market by market basis their dominance is increasingly indistinguishable from a true monopoly.