In a competitive market, pricing is dynamic – you can’t reliably plan more than one or two moves ahead. But in a de facto monopoly – either a single seller or a duopoly with a weak second banana – you can lay out a long term roadmap and follow it relentlessly.

That’s what one noted financial analyst thinks the two big U.S. cable companies are doing. According to a story in FierceCable, Jonathan Chaplin, an analyst at New Street Research, thinks cable broadband prices will double in the coming years…

“Comcast and Charter have given up on usage-based pricing for now; however, we expect them to continue annual price increases,” Chaplin said. “As the primary source of value to households shifts increasingly from pay-TV to broadband, we would expect the Cable companies to reflect more of the annual rate increases they push through on their bundles to be reflected in broadband than in the past. Interestingly, Comcast is now pricing standalone broadband at $85 for their flagship product, which is a $20 premium to the rack rate bundled price.”

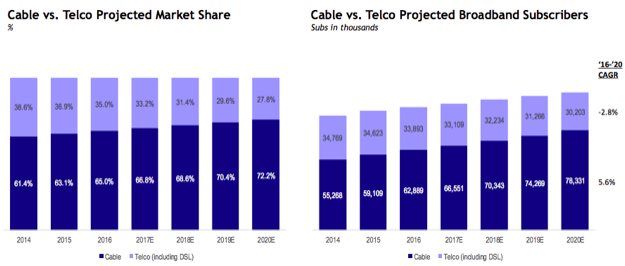

Chaplin estimates that cable companies have 65% of U.S. broadband customers now, and that share will grow to 72% over the next three years.

That kind of market dominance is something that cable companies want to keep out of the public eye. It’s why they push back hard against raising broadband standards: if, say, California adopted the Federal Communication Commission’s 25 Mbps download/3 Mbps upload speed standard as the minimum necessary to participate fully in the digital economy, then cable companies would have an effective, and easily documented, monopoly on broadband service. That would invite regulation, which is something that cable companies aggressively – and rationally – lobby to avoid.

But government-set standards are a poor substitute for market realities. If cable operators have gained a controlling market share by being the only option for the service levels that consumers demand, then it’s game over. They will have – do have, as Chaplin implies – the power to set rent-extracting prices without regard for troublesome competitors.