Three-quarters of all Internet traffic is video and that share will grow to 82% over the next five years, according to the latest update to Cisco’s Visual Networking Index, which is an ongoing broadband tracking study published by the company. Cisco also projects that global Internet traffic will more than triple over that time.

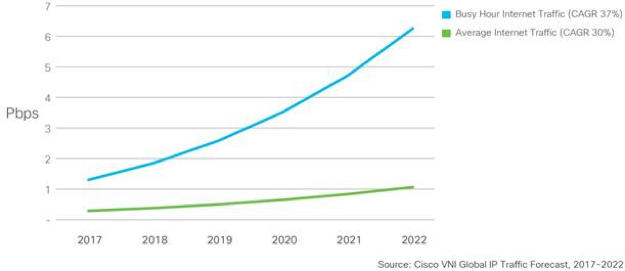

In other words, video is why there’s rapidly rising demand for faster broadband service speeds, and greater capacity. Not just because there’s more of it, but also because people don’t watch it consistently over the course of the day: the ballooning volume of video traffic is crammed into prime viewing hours. Cisco also predicts that the busiest hour of any given Internet service provider’s day will get even busier, with a compound annual growth rate (CAGR) of 37%, versus a 24-hour average CAGR of 30%…

Video is the underlying reason for accelerated busy hour traffic growth. Unlike other forms of traffic, which are spread evenly throughout the day (such as web browsing and file sharing), video tends to have a “prime time.” Because of video consumption patterns, the Internet now has a much busier busy hour. Because video has a higher peak-to-average ratio than data or file sharing, and because video is gaining traffic share, peak Internet traffic will grow faster than average traffic. The growing gap between peak and average traffic is amplified further by the changing composition of Internet video. Real-time video such as live video, ambient video, and video calling has a peak-to-average ratio that is higher than on-demand video.

To keep pace, broadband providers will have to offer faster speeds to meet the heavier bandwidth requirements of live video and higher definition formats such as 4k television, and increase network capacity to maintain those speeds during the nightly viewing spikes.

Fiber-to-the-premise networks can scale like that. Some copper systems can probably keep pace too, if ISPs spend enough on upgrades. Those are investments that can pay off in the high potential areas monopoly-model telecoms companies, such as AT&T and Comcast, focus on. But fixed wireless systems, particularly of the sort that AT&T and Frontier plan to deploy in rural areas using federal subsidies, cannot.