![By shstrng [CC BY 2.0 (https://creativecommons.org/licenses/by/2.0)], via Wikimedia Commons](https://www.tellusventure.com/images/2015/2/shark_boy.jpg)

It won’t get any better when the referee leaves the ring.

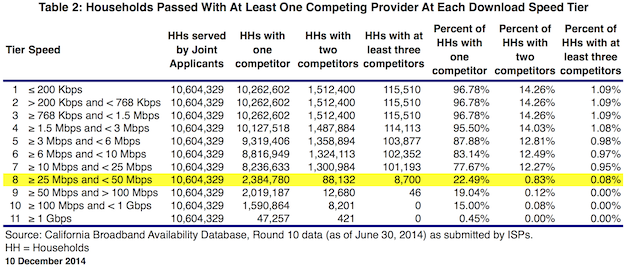

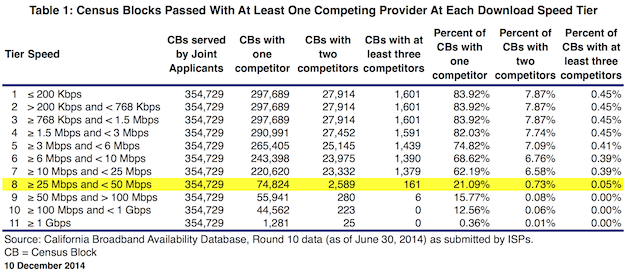

One of the more fascinating aspects of a proposed California Public Utilities Commission decision approving the Comcast/Time-Warner/Charter mega merger and market swap is an analysis of the resulting broadband market in the state. Prepared for the CPUC’s office of ratepayer advocates by Lee Selwyn, a telecommunications analyst, the study reaches the bottom line conclusion that if Comcast swallows up all of Time-Warner and Charter subscribers in California (except for Charter’s subs in the Lake Tahoe area), Comcast would have monopoly control of the broadband market in 78% of its expanded service area.

That’s using the FCC’s new broadband standard of 25 Mbps download speed. If you run it based on the CPUC’s current minimum of 6 Mbps down, Comcast’s monopoly control drops to 17% – that’s largely because AT&T offers at least 6 Mbps down in most of its service area, but not 25 Mbps.

From a microeconomics standpoint, though, a duopoly isn’t much better than a monopoly – either way, the companies involved can control pricing and service levels without much regard for consumers. Selwyn’s calculations show duopoly control of the new service area at 99% for 25 Mbps service and 88% for 6 Mbps.

As bad as it looks, the reality is probably be worse. The published numbers don’t include upload speed calculations. Given AT&T practice of squeezing more download speed out of ageing copper systems by sharply throttling upload capacity, Comcast would have an even greater monopoly and duopoly control.

The proposed decision also pegs Comcast’s prospective combined share of Californian households at 84%, a figure supported by Selwyn’s analysis. In other words, at the 25 Mbps level, Comcast would have monopoly control of two-thirds – 66% – of Californian homes, and be the dominant duopoly partner in about three-quarters – 74% – of the state at 6 Mbps.

Selwyn’s report is being kept confidential by the CPUC, at least for the time being. He used data provided by the companies that’s so far been deemed proprietary, so there’s no opportunity to dive deeper into it.

But the published figures tell a damning story. If the merger and market swap is approved, Comcast would have effective control of broadband service in California, and be able to maximise the value of the money it stuffs in political pockets at the state capitol and the local level.

The proposed decision includes a number of conditions Comcast would have to meet – including pricing, customer service and simple good behavior – but only for two to five years. Comcast’s stranglehold, though, would be permanent. Californians would be better served if the CPUC rejected the merger completely.

Download the numbers in a spreadsheet here.